Resources

Your hub for expert insights, real-world strategies, and thought leadership on tax compliance, remote work, business travel, and workforce mobility.

Blog

Get expert takes and actionable insights to help you manage mobility, mitigate tax risk, and stay audit-ready—wherever work happens.

Top 5 Tax Compliance Mistakes Companies Make with Distributed Teams (and What Leaders Should Know)

Remote work, hybrid schedules, frequent business travel, and cross-border projects have completely changed how (and where) work gets done (and are no longer attributed to...

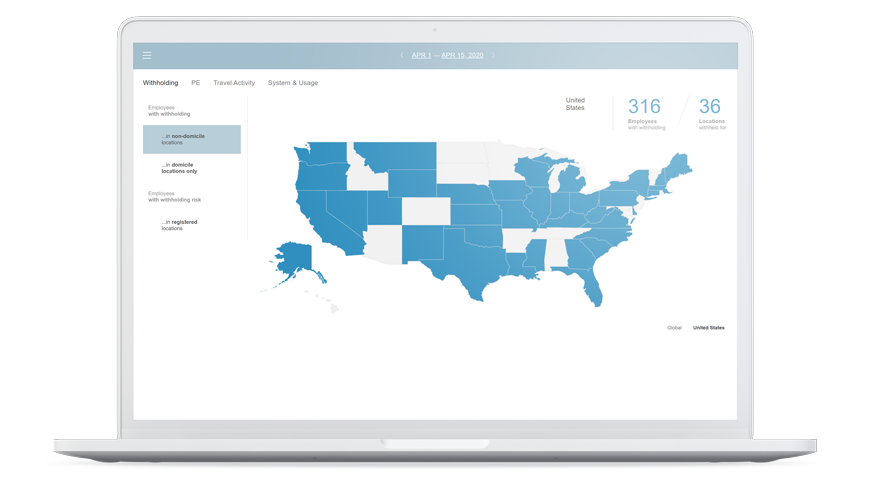

Human Mobility in the Modern Workforce: Managing Work Location, Risk, and Tax Compliance

Work used to be tied to a place. An office. A headquarters. A desk with your name on it. Now? Work follows people, not buildings....

Year-End Tax Compliance Checklist: 10 Things to Review Before January

Year-end is full of people on the move.

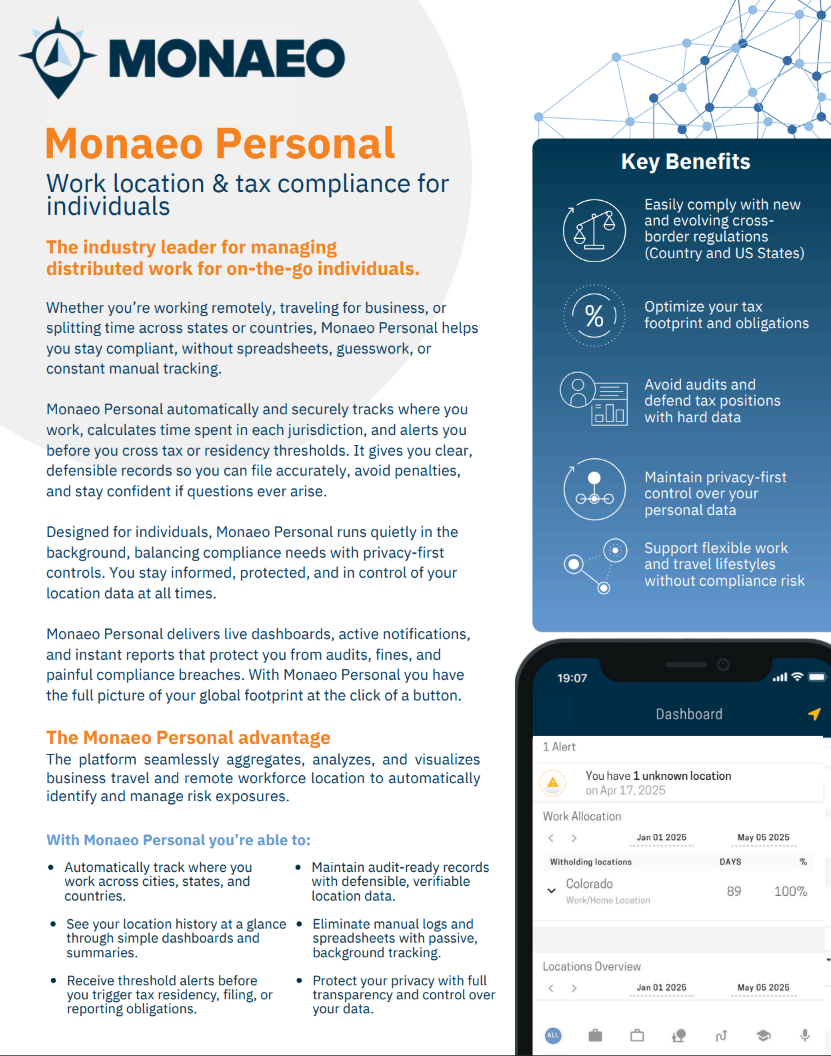

Who Is Monaeo? Simplifying Tax Compliance for the Modern, Mobile Workforce

The truth is, most people don’t think about tax implications when they open a laptop somewhere new; they’re just getting their work done. But modern...

What Is Permanent Establishment & How Can You Avoid Triggering It?

Let’s be honest, “permanent establishment” sounds like one of those dry tax terms you’d rather not think about. But if your company has people working...